Global availability

Global payment management, we give merchants the ability to accept payments globally with stripe Build online revenue without payment management headaches, no matter where your clients are..

allows your customers to checkout on secure payment page

Payske

team has come up with a new and unique innovations make hosted checkout as flexible quick and more effectively. Enjoyable as possible!

Payske

team has come up with a new and unique innovations make hosted checkout as flexible quick and more effectively. Enjoyable as possible!

These innovations have come from research and delving into the problems that many businesses face when dealing with online payments.

We are certain that this new and unique innovations that we offer will contribute to the success of online shopping very significantly, and streamline online payments between merchants and their customers, to make the online payment an easy task.

Hosted Checkout

Plus +

The Feature Benefit

Hosted Checkout

Plus +

The Feature Benefit

On-client-side only integration

Accept payments with just a few lines of code on-client-side only, your are not need to server-side integration for simple checkout with basic features.

With the on-client-side only integration, you integrate Checkout into your website without any server-side code. you define your products directly in the Payske Dashboard and reference them by ID on the client side.

No-code: If you have not developer you don’t need to write code you can use html form only to integrate Checkout into your website without any js script.

Few lines of code: for simply integration with more control on client you must use js SDKs for fast integration with few lines of code.

Problems you face

Client and server integration needs complex development, accessing the server and writing more code in both sides on client and server and spending more cost, time and effort although you only need to simple checkout with basic features.

.

A continuous presence throughout the day is beyond your capacity and may lead to a halt or cause collapse, loss of customers and a major loss. Or you must create links to cover all possible possibilities, which may reach a very large number depending on the number of products you offer.

The code examples Payske

In first create product:

- Go to the Products section in the Dashboard

- Click Add product

- The product name, description, price and image that you supply are displayed to customers in Checkout.

The HTML form method:

<form method="post" action="https://checkout.payske.com/checkout/session">

<input name="api_token" type="hidden" value="tk_test_1AAcsdCFfrt545FVGFcsdCFfrt545FVGFd56VjFDfgid56VjFDfgicsdCFfrcsdCFfrt545FVGFd56VjFDfgit545FVGFd56VjFDfgi">

<input name="checkout_config_id" type="hidden" value="cocfg_TcFBuMen0pON9nh7ybvF4FD">

<input name="line_items[0][price]" type="hidden" value="price_1MotwRLkdIwHu7i">

<input name="line_items[0][quantity]" type="hidden" value="3">

<input name="line_items[1][price]" type="hidden" value="price_1MdIwo7itwRHuLk">

<input name="line_items[1][quantity]" type="hidden" value="2">

<input name="line_items[2][price]" type="hidden" value="price_1Mnbd6gbbnb7gk">

<input name="customer_email" type="hidden" value="customer@example.com">

<input name="mode" type="hidden" value="payment">

<input name="submit_type" type="submit" value="pay now">

</form>

The JS Code method:

Create checkout session:

Checkout relies on Payske.js. To get started, include the following script tag on your website—always load it directly from https://js.payske.com/v2/

const payske = await loadPayske('pk_test_TYooMQauvdEDq54NiTphI7jx');

When your customer is ready redirect To Checkout to begin the checkout process. Pass it an array that specify the price ID or product Id and the quantity of each item:

const session = await payske.checkout.sessions.create({

checkout_config_id: “cocfg_TcFBuMen0pON9nh7ybvF4FD”,

customer_email: "customer@example.com",

submit_type : ‘pay now’,

line_items: [

{

price: 'price_1MotwRLkdIwHu7i',

quantity: 2,

},

],

mode: 'payment',

});

// * Redirect to checkout:

payske.redirectToCheckout({ sessionId: session.id })

.then(function(result) {

// If fails due to a network error,

// you should display the error message using `error.message`.

if (result.error) {

alert(result.error.message);

}

});

Introduction

Introduction

When planning your online checkout experience, convenience is key, both for you and for your customers. Hosted payment pages are worth considering for your business—whether you primarily deal with one-time payments —due to their efficiency, security, and ability to create simple transaction experiences for your customers.

Creating a comprehensive plan to accept payments from customers is a big undertaking. But a strategic approach to payments and payment processing is as important as your product-development, marketing, and customer-service strategies. Evaluating options like hosted payment pages is necessary for a well-planned payments ecosystem.

If you’re considering hosted payment pages for your business, here’s what you need to know.

We built Checkout for you

Payske Checkout is a prebuilt payment form optimized for conversion. Redirect customers to a Payske-hosted page to easily and securely accept one-time payments.

Designed to reduce friction

Let your customers breeze through the checkout by making it easy for them to input and reuse their payment information and by helping them spot errors in real time.

Address auto-complete

Real-time card validation

Descriptive error messages

Third-party autofill

Card brand identification

Payment method reuse

Adjustable quantities

Increase sales with a better payments experience

We obsess over every detail of the checkout page—from its load time to the smallest animation. we working continually to increase sales on your behalf.

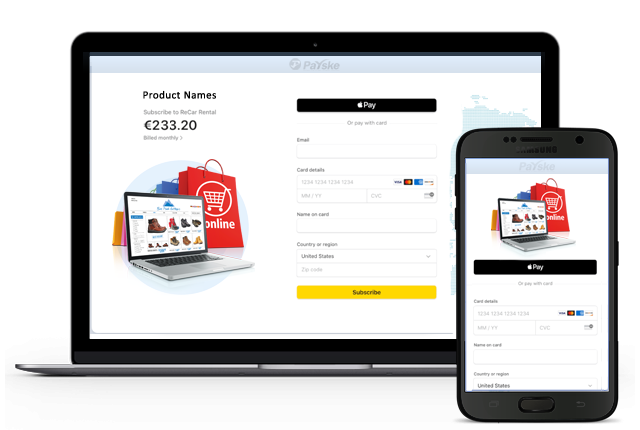

Provide an optimal experience across mobile, tablet, and desktop with a responsive checkout, and offer Link, Apple Pay and Google Pay out of the box.

Reduce friction at checkout and enable your customers to check out faster when paying with Link, Apple Pay or Google Pay.

Built for global customers

Checkout supports 11+ languages, 135+ currencies, and dynamically shows the payment methods and currency most likely to improve conversion.

Your brand, your Checkout

Customize Checkout’s colors, fonts, shapes, and brand settings to match the look and feel of your site. Checkout direct customers to a Payske-hosted page.

Supported use cases

One-time payments: Accept payments for digital or physical goods.

Saving payment details: Collect your customers’ payment details for later use.

Pay-what-you-want payments: Let your customers choose how much to pay

Payment methods

Card payments: Accept credit and debit cards from all major card brands.

Apple Pay: Offer Apple Pay out of the box to customers who have set it up on their device or browser—no domain registration required.

Google Pay: Offer Google Pay out of the box to customers who have set it up on their device or browser.

Built-in features

Simplified PCI validation: Minimize your PCI burden—Checkout lets you qualify for the simplest form of PCI validation, a prefilled SAQ A.

Email receipts: Send automatic email receipts after a successful payment or refund.

Email receipts: Send automatic email receipts after a successful payment or refund.

Coupons and promo codes: Generate coupons to provide customers with promotions and discounts with built-in validation logic.

Address collection: Collect your customers’ billing or shipping addresses, powered by our address autocomplete for easier input.

Language support: Offer a localized checkout page in over 11 languages.

Fraud logic: Use machine learning to block fraudulent transactions and apply extra authentication to high-risk payments or when required by regulation.

Card testing protection: Protect your business from card testing without impacting conversion by triggering CAPTCHA in case of an attack.

Adjustable quantities: Let your customers adjust item quantities directly on the checkout page.

Store policies: Highlight your return policies, support contact information, or links to terms of service on the checkout page to increase buyer confidence.

Phone number collection: Collect customer phone numbers for shipping or invoicing.

Shipping method selection: Let your customers choose the shipping rate that works for them

Customer portal: Let your customers manage their payment details by sharing a link to a secure, prebuilt customer portal.

Conversion optimizations

Present local currencies: Show prices in your customer’s local currency to improve conversion rates.

Branding customization: Customize Checkout’s colors, fonts, shapes, and brand settings to match the look and feel of your site.

Payment method optimization: Dynamically show the payment methods most likely to increase conversion based on your customer’s location and preference.

Responsive design: Offer an optimized experience across desktop, tablet, and mobile with a payments page that adapts to the size of the screen.

Address auto-complete: Make it easier for your customers to enter their address with our address auto-complete.

Card validation: Provide real-time feedback as your customer types their card information to minimize errors and reduce dropoff.

Email validation: Highlight potentially misspelled email domains to avoid capturing incorrect email addresses.

Descriptive error messages: Use descriptive and localized error messages to help your customers correct mistakes.

Third party auto: fillLet your customers use payment details stored in their browser to breeze through the checkout.

Card brand identification: Use the first digits of your customers’ cards to validate the card brand and increase their confidence.

What is a hosted payment page?

What is a hosted payment page?

A hosted payment page is a web page, hosted by a third party, that provides secure checkout capabilities for business websites. It allows businesses that accept online payments to avoid building—and then managing—their own payment gateways on their websites.

Hosted payment pages can accept a variety of payment methods, including:

Credit cards

Debit cards

Digital wallets (Apple Pay, Google Pay, Amazon Pay, etc.)

Bank accounts via ACH payments

Hosted payment pages are also known as “external checkouts,” “third-party checkouts,” “hosted payment gateways,” “external payment pages,” and “checkout pages.”

How does a hosted payment page work?

How does a hosted payment page work?

Hosted payment pages take care of electronic transactions from beginning to end, including:

Accepting payment information from the cardholder

Gathering details for card authorization, like the card number, expiration date, CVV code, and the cardholder’s ZIP code

Sending payment information to the business’s payment processor, who will then send it to the card issuer for authorization

Confirming shipping details, like shipping address and shipping priority level (standard ground delivery, two-day delivery, overnight delivery, etc.)

Returning card authorization or refusal

Providing customers with confirmation codes or order numbers

Initiating an email receipt for the customer, if applicable

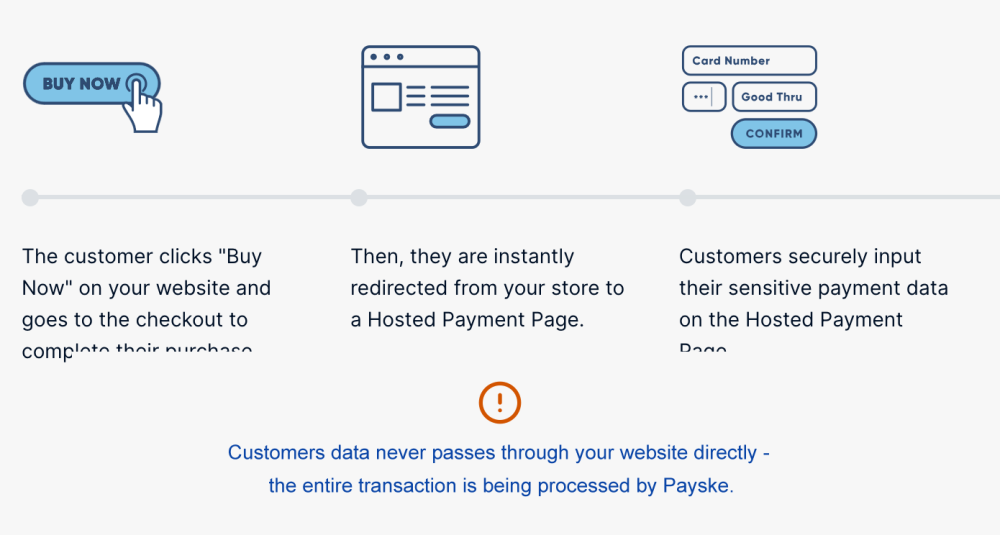

Here’s how the customer checkout experience looks when using a hosted payment page:

On the business’s website, the customer adds items to their virtual cart and clicks the checkout button.

The customer is redirected to the checkout page, which is hosted by an external service.

The customer inputs payment information, shipping details, and any other necessary information.

After the customer’s card is authorized, the customer is notified that the transaction has been completed and they are routed back to the business’s website.

Increasingly, online businesses have access to different options for hosted payment pages—like Payske Checkout—that allow you to control how the pages look and match the visual branding of the rest of your site. You can customize colors, fonts, shapes, and other visual-branding settings—and you can use your own domain. The end goal is for the payment page to fit seamlessly into your website.

Hosted payment page benefits

Hosted payment page benefits

If you do choose to use a hosted payment page, it will come with substantial benefits, including:

No technological development

Businesses don’t need to undertake any payment infrastructure development or maintenance on their side to start accepting payments via HPP. It allows merchants to avoid spending plenty of costs and resources as the infrastructure is provided and maintained by a specialized third-party payment system provider. Also, with no technological development, merchants can redirect their focus and resources to their core business activities rather than diverting efforts into maintaining payment infrastructure.

Quick implementation

Due to the pre-built nature of hosted payment pages, they are quickly integrated into the merchant’s website, allowing them to start accepting payments for goods and services in no time.

Enhanced security

As the customer enters their payment information on the third-party page of the payment provider, their data is safeguarded through mandated security protocols. Plus, the merchant’s website does not handle sensitive transaction details, minimizing fraud and data breach risks.

Simplified PCI validation

Minimize your PCI burden—Checkout lets you qualify for the simplest form of PCI validation, a prefilled SAQ A.

Streamlined checkout

Streamlined checkout

HPP is developed by experts who have extensive experience in this field. Due to this, hosted pages for payment ensure the security of sensitive data and integrate a user-friendly design to minimize errors. Furthermore, HPP often employs advanced financial technologies that decrease the likelihood of false declines. This way, HPP contributes to a smooth and reliable payment flow, lowering cart abandonment risk.

Universal device compatibility

Hosted payment pages are designed to work with every device your customers use to shop. Payske Checkout has an intuitive, responsive checkout page for smartphones, tablets, and desktop computers. In addition to working fluidly across devices, Payske hosted payment pages easily accept leading digital wallets like Apple Pay and Google Pay.

Merchant Support

If you are already using Payske services and have questions about integration.

We can help you to Integration your online store with our payment system to ensure that problems are not encountered and risks are reduced. Our developer team will Integration your online store with the payment system and it will save you time and effort and reduce the costs of the Integration process. Please go to the

Integration Help page.

Scale your business globally with Payske platform.